Blogs

September 13, 2024Methanol to gasoline (MTG): An old dog with new tricks

The Origin Story: Going Back to the ‘70s

The Methanol-to-Gasoline (MTG) process was first developed in the 1970s by Mobil (now ExxonMobil) converting methanol to gasoline using a zeolite ZSM-5 catalyst. The first commercial MTG facility was established in 1985 using natural gas. There are currently four main primary technologies that can convert methanol feedstock or intermediates into gasoline and/or gasoline blendstocks. These processes are technologically ready with some referenced in existing operational facilities and others in recent project announcements, often based on renewable feedstocks, including woody biomass, renewable hydrogen produced by water electrolysis and captured carbon dioxides (CO2).

What’s New? Low Carbon Intensity (CI). How? Low CI Methanol

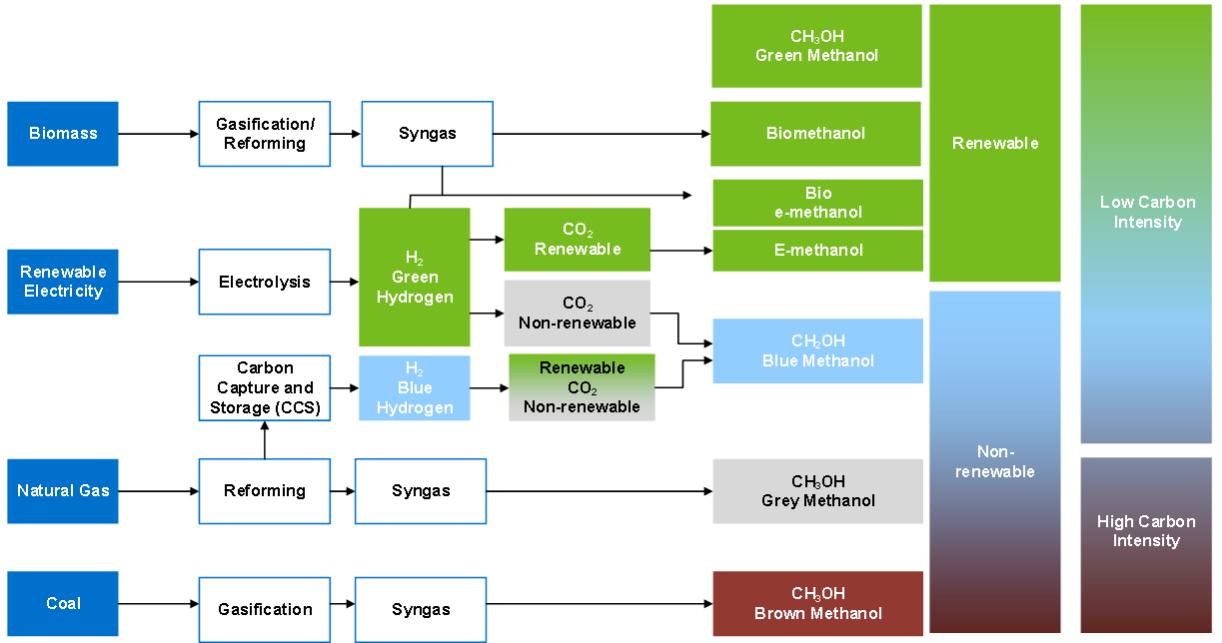

Methanol to gasoline technology has the potential for producing a very low carbon intensity (CI) gasoline product; but only if paired with a low CI methanol feedstock such as e-methanol. Despite electric vehicles (EVs) making large strides, renewable gasoline is an important tool for decarbonizing the transportation sector as significant swaths of the market are reticent to EV uptake, along with existing fleets of vehicles requiring traditional fuels. Therefore, if net zero goals are to be achieved, renewable gasoline will have a role to play. Large carbon intensity reductions combined with a conducive credit environment and strong government support globally shows high potential for proliferation as 2050 approaches. Renewable methanol can be commercially produced through feedstock switching from conventional natural gas-based reforming technologies to biogas, biomass (including municipal solid waste or MSW) gasification, or power-to-methanol technologies that utilize green hydrogen and CO2. The production of methanol from biomass and from CO2 and H2 does not involve experimental technologies as proven and fully commercial technologies used for methanol production from fossil fuel-based syngas can also be applied for bio- and e-methanol production.

Primary Renewable-based Routes to Methanol

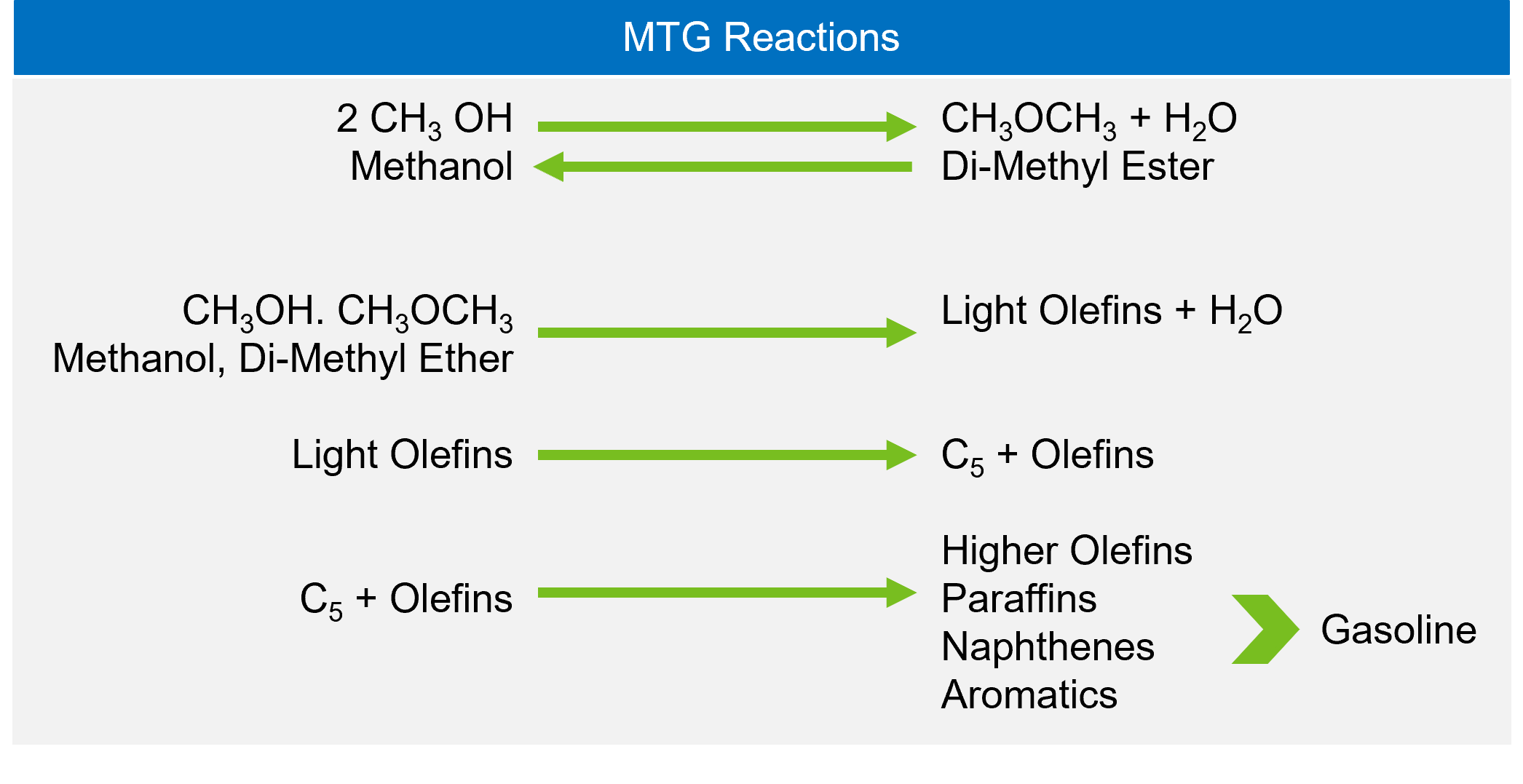

NexantECA has investigated the MTG technologies. The reaction sequence of the MTG process can be summarized as follows:

MTG Reaction Sequence

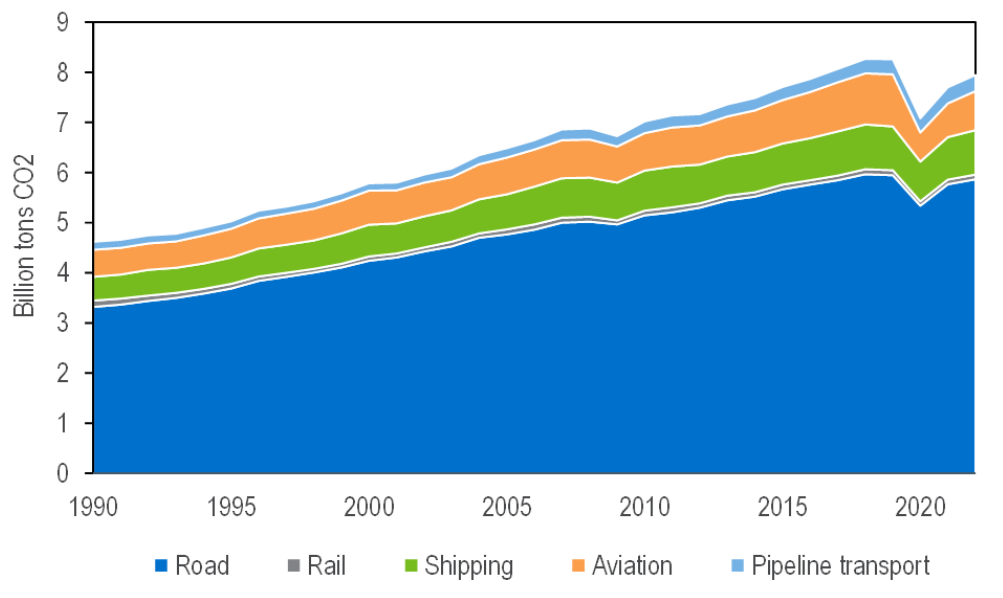

What’s the Big Deal? Road Emissions from Passenger Vehicles (Mostly Gasoline Powered) are the Largest Contributor

Road transport - both passenger and freight - has the highest carbon footprint among all transportation modes, accounting for approximately 75 percent of total global transport GHG emissions. The primary contributor of these emissions is the scale of consumption of combustible fuels, with diesel and gasoline the most consumed.

Global CO2 Emissions from Transport by Sub-sector, 1990-2022

(Source: IEA)

In 2023, the global road vehicle fleet increased by an estimated 28 million units, or 1.1 percent, reaching approximately 2.68 billion units. Passenger cars and two/three-wheeled vehicles, predominantly powered by gasoline, constituted approximately 51 percent and 40 percent of the global fleet, respectively. While demand for road freight is projected to continue to grow to 2050, the sector must almost entirely decarbonize within the same timeframe to meet the Paris Climate Agreement’s net-zero emission target by 2050 and limit global warming to 1.5 °C above pre-industrial levels. Gasoline powered vehicles with internal combustion engines or hybrid powertrains are expected to remain as the majority in most regions, except where internal combustion engine (ICE) car sales bans are being implemented during the 2030s.

Aligning the road transport sector with Net Zero necessitates a broad set of policies to promote a shift to less carbon-intensive travel options and enhance operational and technical energy efficiency measures to reduce the carbon intensity of the fuel pool. While renewable fuels, such as renewable gasoline, will not replace electromobility, they complement it, especially in the markets where there is as yet no clear and economical path to electrification. To promote rapid market uptake for these fuels, effort should focus on renewable biomass and synthetic fuel components that can be blended into conventional fuels at high proportions in line with existing fuel standards.

Why Renewable Gasoline? Electrification and Ethanol Blending Won’t Wrangle Gasoline’s Emissions Alone

In 2023, the global fleet of passenger vehicles was estimated at 1.4 billion, with an average lifespan of more than ten years and gasoline vehicles comprising nearly 80 percent of this total. With the current decarbonization policies for road transport, the number of gasoline vehicles globally is expected to grow through the 2040s, barring substantial electrification efforts in most of the Asian markets. More aggressive electrification is anticipated in regions such as Western Europe and North America, where bans on the sale of new ICE vehicles are slated for the 2030s. While production costs for EVs, notably batteries, continue to decline in line with historical trends, EVs are expected to remain economically uncompetitive with ICEs in the near to medium term. Consequently, sustained government support will be essential in most markets to bolster the adoption of EVs.

While the long-term goal for decarbonizing road transport may be full electrification, renewable gasoline serves as a transitional solution to bridge the gap, enabling near-to-medium term emission reductions while infrastructure for full electrification is developed. A combination of electrification and renewable fuels, such as biofuels and electrofuels (e-fuels), is needed to approach climate neutrality in the automotive sector. In the short-term, the main increase in biofuel volumes will be in the form of first-generation biofuels outside of the EU, with long-term policies targeted to increase volumes of advanced/second-generation biofuels which can be manufactured from various types of non-food biomass. It is not the availability of waste-based or lignocellulosic feedstock, such as MSW and agriculture residues, that limits the commercial development today, but commercial investments in production capacity.

The GHG mitigation efficacy of both electrification and renewable fuels has been discussed in recent years. Battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) running solely on electricity have zero tailpipe emissions. However, emissions can still occur from other aspects of the lifecycle of the vehicle, including battery production, electricity generation and energy transmission and distribution. In regions using relatively low-polluting energy sources for electricity, electric vehicles generally have a significant life cycle emissions advantage over similar conventional gasoline or diesel vehicles. Conversely, in areas where electricity relies heavily on fossil fuel, the life cycle emissions benefit of electric vehicles is not as pronounced.

Biofuels, on the other hand, have been extensively discussed in terms of their indirect GHG emissions due to potential indirect land-use change (ILUC) when growing feedstock crops. To avoid potential negative ILUC effects, current policies have been promoting biofuels from non-crop biomass feedstock, such as residues from agriculture and forestry. Renewable gasoline is a drop-in renewable fuel which does not have to be sourced solely from biomass and can also be synthesized using renewable electricity. Many governments recognize biomass as a carbon-neutral energy source on the basis that the CO₂ emitted during fuel combustion originated from that absorbed from the atmosphere during plant growth. Renewable gasoline thus represents a practical and appealing alternative to vehicle electrification, capable of supporting substantial emission reductions and advancing the transition towards a more sustainable transportation future. Compared to current battery technologies, renewable gasoline has a higher energy density allowing vehicles to travel longer distances on a single refuel and therefore providing time for EV scale up of battery technologies and improved charging infrastructure.

Ethanol has also long been the most widely used biomass-based road fuel substitute globally and is blended into gasoline in the large North American market and used either in blends or directly via flexible-fuel vehicles in Brazil. North America accounts for over half of global ethanol consumption with the United States being both the primary global producer (from corn) and major gasoline consumer. South America accounts for another 28 percent of global ethanol consumption, largely due to the significant proportion of flexible-fuel vehicles in their passenger fleet.

In the United States, the federal Renewable Fuel Standard (RFS) mandates increasing amounts of renewable fuels to be blended into the national fuel supply. However, infrastructure and vehicle compatibility issues have historically limited the market to the E10 blend, known as the blend wall, which comprises 10 percent ethanol and 90 percent gasoline. The blend wall represents the point at which fuel dispensing infrastructure and vehicle engines would need to be modified to be compatible with blends greater than E10. The U.S. gasoline market has now reached a point where nearly all gasoline sold is E10.

Similarly, the European Union (EU) has renewable energy directives aimed at promoting biofuels, but the adoption of higher ethanol blends like E10 has been slower compared to the U.S. Since 2011, the maximum limit for ethanol content in gasoline in Europe is E10, with E5 available for vehicles which have not been declared E10 compatible. Despite this the E10 market share is expected to continue rising in many European countries where it is already in use, aided by the gradual replacement of older vehicles with newer models that are E10 compatible.

The United States and Europe both face technical challenges in ensuring that vehicles and infrastructure can handle higher ethanol blends without performance or safety issues. In the U.S., the saturation of the country’s gasoline supply with E10 has motivated the ethanol industry to seek approval for a midlevel ethanol blend, E15. While newer vehicles can typically use E15, the transition requires consumer education and acceptance.

Renewable gasoline presents an appealing alternative - chemically equivalent to petroleum-derived gasoline it can be used in existing vehicles and fuel infrastructure without requiring modifications and face no blending limits. Moreover, renewable gasoline technologies can process a variety of feedstocks, such as biomass, waste materials, low-emission electricity and captured CO2. This feedstock diversification reduces reliance on corn-based ethanol and promotes the use of waste materials contributing to a circular economy.

Find out more…

Biorenewable Insights: Methanol to Gasoline (MTG) (2024 Program)

This report assesses the conversion technology of renewable methanol to gasoline in terms of their technical, economic, and carbon intensity aspects, aligning with efforts of transitioning to more sustainable fuel to achieve net zero emission by 2050. This report also presents a comparative analysis of the overall carbon intensity, considering scope 1 and scope 2 emissions in these production pathways. The four MTG technologies profiled in this report include:

- ExxonMobil’s Fixed-Bed and Fluid-Bed MTG

- Topsoe’s Improved Gasoline Synthesis (TIGASTM)

- Verde Clean Fuel’s Syngas-to-Gasoline-Plus (STG+®)

- Sedin Engineering’s One-Step MTG

Profiles include technology descriptions and analysis of announced capacity. Analysis including estimates of cost of production and carbon intensity are included for ExxonMobil’s Fixed-Bed and Fluid-Bed MTG and Topsoe’s Improved Gasoline Synthesis (TIGASTM).

Market Analytics: Methanol - 2024

This report provides analysis and forecasts to 2050 of supply and demand of the global methanol markets. Methanol demand is segmented by acetic acid, DME, formaldehyde, olefins, MTBE, biodiesel, gasoline blending, marine fuel and others. This analysis identifies the issues shaping the industry as well as provide demand, supply and net trade data for 40 countries.The Executive Summary is available to subscribers as a separate document.

The Author...

Steve Slome, Principal

About Us - NexantECA, the Energy and Chemicals Advisory company is the leading advisor to the energy, refining, and chemical industries. Our clientele ranges from major oil and chemical companies, governments, investors, and financial institutions to regulators, development agencies, and law firms. Using a combination of business and technical expertise, with deep and broad understanding of markets, technologies and economics, NexantECA provides solutions that our clients have relied upon for over 50 years.