Blogs

May 10, 2021Counting the cost, disappearing caprolactam profit margins

Caprolactam producers are increasingly integrating downstream, both to improve profitability as well as consume caprolactam captively - reducing dependency on merchant market prices and demand.

The nameplate capacity of a large-scale caprolactam plant typically far exceeds the size of downstream polyamide 6 plants. Hence, major players are believed to distribute caprolactam production within their network of converters, which they develop both organically and through acquisition. It maximizes the captive consumption of caprolactam, effectively reducing the size of caprolactam’s merchant market and protecting caprolactam producers - e.g., in Western Europe - exposed to producers in lower-cost regions.

The challenge is that the closer the player is to end-user markets, the greater the range of their potential product portfolio, increasing the complexity of their business model. Furthermore it is difficult and expensive to enter these markets for which reason it is considered relevant to develop a model examining the effect of integrating a caprolactam facility upstream as well as downstream.

Integrating the facility upstream lowers the cost of production as the total cost of producing the feedstock is generally lower than the market rate, primarily through the elimination of transportation costs. Integrating downstream increases overall costs; however, these are offset by the production of more specialized products, sold at higher prices and traditionally increasing profitability.

The realized profit margin depends on the age of the plant, company strategy, and market dynamics in other end-use markets for additional feedstocks and by-products. It should also be noted that cost reductions in this evaluation could be further extended by sharing facilities or utility integration within a single complex.

Cyclohexane or phenol can be used as the primary feedstock in caprolactam production. The cyclohexane route is more commonly used in industry, however, we have reviewed an integrated phenol complex, reducing the complexity associated with a large cyclohexane facility. It also includes a continuous polymerization system.

Implementing Integration

Four possible scenarios for caprolactam producers are given to estimate the cost of production and margins for the different output products. These represent standard configurations for producers in all regions. The margin is assumed to be drawn at the facility that produces the final product

Products for Different Levels of Integration

The evaluated caprolactam and phenol plant have a capacity of 300 000 tons per year, and a polyamide 6 plant of 200 000 tons per year. These integrated facilities often have larger than average capacities when compared to a non-integrated site.

A proportion of each intermediate product is siphoned off to be sold, reducing the exposure to any single end-market

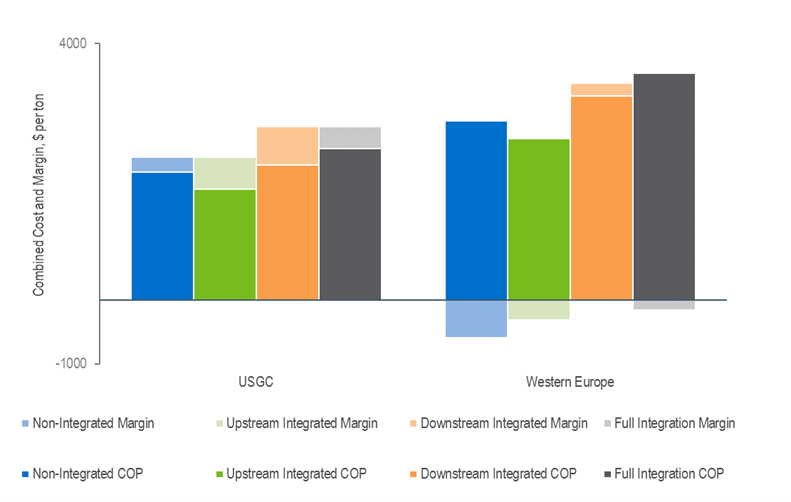

Comparison of Different Caprolactam Facility Configurations, Cost of Production and Margins (1Q2020, US dollar per ton product)

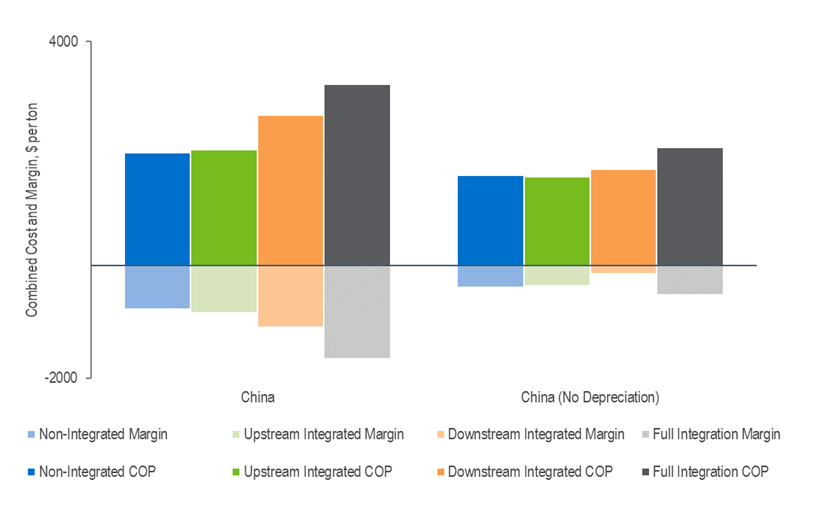

Comparison of Different Caprolactam Facility Configurations, Cost of Production and Margins (1Q2020, US dollar per ton product, China)

The benefits of upstream integration can be seen for both Western Europe and USGC, where it decreases the cost of production by nine and thirteen percent per ton respectively. Despite overall negative margins in this time-period integration may be beneficial for a producer operating on slim margins.

However, in China the cost of production increases by three percent. This effect is determined to be the result of high feedstock prices. During the beginning of 2020, China began experiencing the effects of the coronavirus pandemic, limiting downstream consumption of phenol and leading to oversupply – resulting in a phenol market price below its cost of production. This effect encouraged suppliers to decide between standalone caprolactam production facilities, buying phenol from the market, or to integrate further upstream into cumene production.

In Western Europe and USGC the result of downstream integration shows a more favourable picture. New products, in this case polyamide 6, are able to fetch a higher price and show positive margins. Ultimately the market for caprolactam and raw polyamide 6 product - e.g., polyamide chips - has become increasingly saturated over the past few years, particularly in China, which has led to a low local market price and aids in explanation as to why Chinese producers are not seen to be making a profit during this time.

Investment in China is conducted under different conditions than the US or Western Europe, which may justify why new caprolactam plants continued to be planned and commissioned throughout 2020. Producers in China that seek financing are supported by the government, hence loans are believed to be obtained at favourable interest rates to the producer - supporting them through economic downturns or unfavourable product market conditions such as can be seen today.

However, not all producers operating within the region face the full cost of production as a significant proportion of the cost for each technology is within depreciation. Figure 2 also shows China’s margins when depreciation is not included in the final costs, and although still negative, are of a much lower magnitude. This is particularly relevant in the case of a downstream integrated plant, which benefit from depreciation more due to the higher capital costs of polymerisation facilities. Some mature producers may have been profitable even at these historically low polyamide 6 prices.

Overall, the benefits of integrating downstream appear more advantageous for caprolactam producers than upstream integration given the higher margins for downstream products. This supports the common trend occurring in these regions where producers from the USGC, Western Europe and increasingly China are operating in a more specialized market, enabling them to further differentiate their products in an increasingly competitive market.

Find out more...

Tech Report: Caprolactam - 2020 provides a comprehensive analysis of the caprolactam industry. In addition to conventional caprolactam production from cyclohexane and phenol, this report also includes coverage of processes using non-conventional feedstocks. The analysis provides cost of production estimates for commercial and developing technologies for caprolactam production, within the USGC, Western Europe and China regions. Market analysis and an industry overview are also included to illustrate the commercial aspect of the industry.

Market Analytics: Caprolactam - 2020 provides an analysis of the global caprolactam with forecasts to 2045. This analysis will identify the issues shaping the industry as well as provide demand, supply and net trade data for 40 countries.

The Author

Katherine Murray, Analyst

About Us - NexantECA, the Energy and Chemicals Advisory company is the leading advisor to the energy, refining, and chemical industries. Our clientele ranges from major oil and chemical companies, governments, investors, and financial institutions to regulators, development agencies, and law firms. Using a combination of business and technical expertise, with deep and broad understanding of markets, technologies and economics, NexantECA provides solutions that our clients have relied upon for over 50 years.