Blogs

September 16, 2024Hot new CCU technologies: Syngas and CO2 fermentation or how to unlock ultra-low CIs

Background

It becomes increasingly clear that the effort to hold global temperature rise to 1.5 degrees Celsius has failed. Governments, industry, and consumers are all demanding action. As ambitious goals have been set, the petrochemical industry is at an “all hands on deck” moment to try to meet these goals. It will take an “all of the above” approach to achieve. Carbon capture, Carbon utilization and storage, electric heating, alternative technologies, power to liquids (PTL), and feedstock switching (to biofeedstocks) will all be parts of the energy and chemicals low carbon intensity future.

A number of species of organisms in nature are known to subsist partially or entirely on methane or mixtures of hydrogen and carbon dioxide that are also common feedstocks for chemical synthesis. All of these species are prokaryotic bacteria with specialized cellular machinery for fermentation of gaseous species. Although these organisms are generally regarded as having primitive pathways in comparison to other types of bacteria and to eukaryotic organisms, such as yeasts and higher plants (in the sense of evolutionary fitness), prokaryotic bacteria utilizing methane and hydrogen-CO2 mixtures are surprisingly common in the environment, subsisting in environments as varied as soil, hot springs, the guts of animals, and deep sea vents.

In recent years, these gas-fermenting organisms have attracted considerable interest from commercial developers of alternative fuels, bio-based chemicals, and foods and feeds. Although these organisms pose considerable process challenges, they offer attractive potential economics and due to the low carbon intensities and ability to utilize CO2 and other waste gas feedstocks—potentially lowering the GHG footprint of other technologies such as steel production. Gas fermenting technologies are now commercially proven and capacity is rapidly growing, particularly with interests in ethanol to jet.

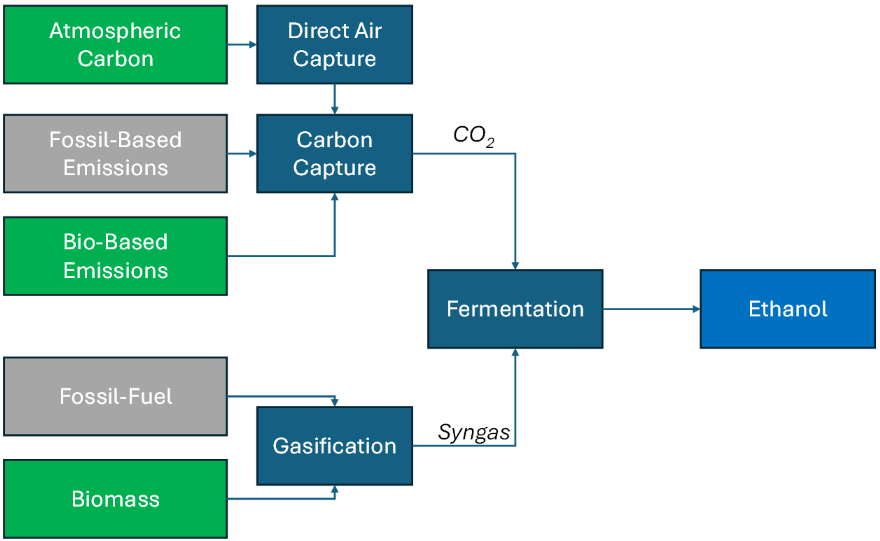

Options for Syngas and CO2 Fermentation

Options for Integration with Carbon Capture, Industry’s Current Sweetheart

The focus of sustainability has shifted in the past decade to a carbon intensity based model, based upon the emissions resulting from the production of the product. Carbon Intensity, a relatively new concept to many in the petrochemical industry, is the measure of how much carbon dioxide equivalent emissions are released per unit of product (ton, MJ, or MWh, depending if it is a chemical, power, or fuel). This normalizes the emissions and makes sustainability efforts difficult to greenwash. Increasingly, many major market players including most international energy companies, chemical companies, and logistics and shipping companies have stated intentions of reducing their carbon intensity. A majority have even stated ambitions of net zero carbon emissions by 2050 and expect either a tax on carbon emissions or a credit for reductions. Increasingly, the financial sector is weighing carbon emissions in investment and are unwilling to fund what they see as ‘dirty projects’.

Commercially proven carbon capture processes are currently bolt-on solutions for decarbonizing existing heavy polluting applications, whereas direct air capture is a way of getting carbon credits to cancel out the applications that cannot be easily decarbonized—the two can help get stakeholders to target net zero emissions without changing the fundamental business model that drastically. Interest remains high in CO2 capture for a few well joined premises:

We are limited by available renewable and sustainable materials and technologies: Simply put, there are not enough renewable feedstocks, renewable power, or renewable technologies available between now and 2050 to eliminate the use of fossil fuels. Even at very impressive industry growth rates—more than any previous industrial revolution—we will still likely fall short. Many will also need a way to offset otherwise uncapturable or ineliminable emissions;

Industry is expecting emissions regulation—and support for emission reduction technologies: Almost all major global multinational energy and chemical companies have publicly stated not only that they expect a carbon tax, cap and trade, and/or some other credit system to help curb emissions in major markets, but that they also support these efforts;

Consequences are stacking for inaction: It is now widely accepted that the global community will most likely not achieve the target of 1.5 degrees (or already has)—more powerful storms, raging fires, rising sea levels, droughts, and other disruptions to global food, chemical, and energy industries are rising with the mean temperature of the planet.

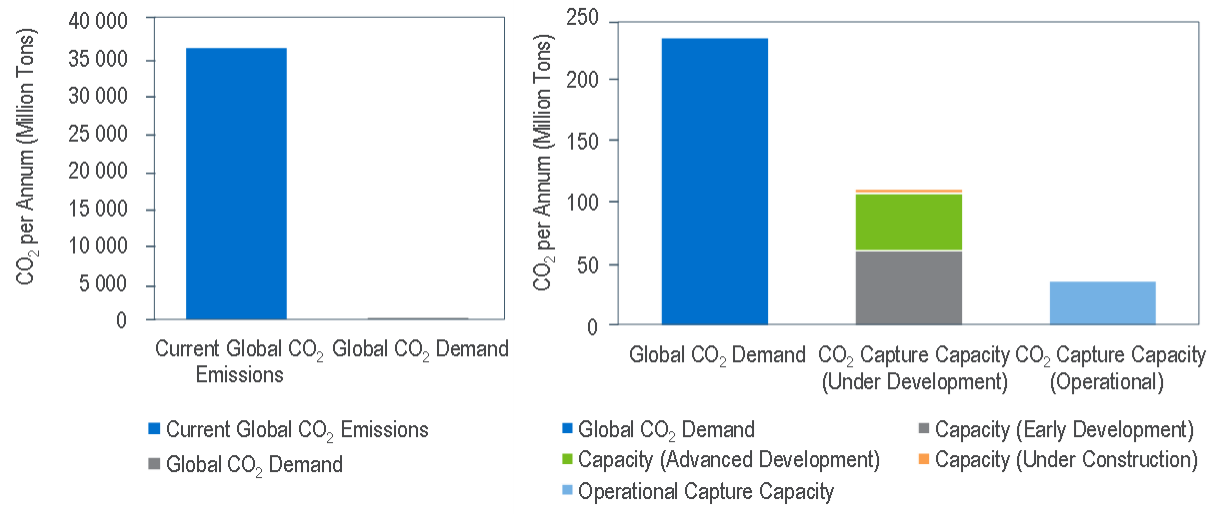

Global CO2 emissions are estimated at around 36.8 billion tons in 2022. For larger context, the total project pipeline capacity, including operational and those under development, totals nearly 149.3 million tons per year which represents less than one percent of the total global CO2 emissions.

Global CO2 Emissions, Demand, and Capture Capacity1

A key piece of the puzzle remains; what is the end-use application for the captured carbon? Capturing carbon is the easier hurdle. Figuring out what to do with carbon is a larger challenge, but one that CO2 fermentation can help with.

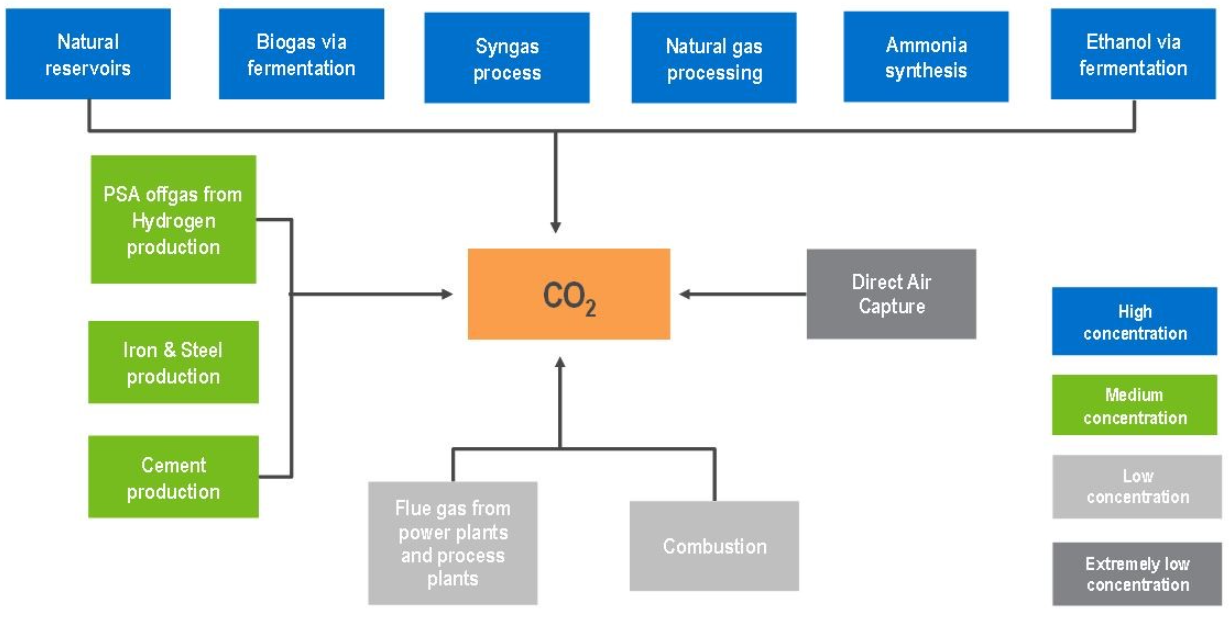

CO2 Supply

Commercial supply is led by sources where CO2 has a very high concentration that provides a cost advantage in both operational and capital terms. Although technically feasible solutions for the avoidance, removal, or redirection of CO2 streams have long existed, the major obstacle has been the economic viability based on the concentration of the emission sources. Global CO2 supply varies from region to region which depends on availability of high concentration CO2, from natural resources and/or industrial activities. The largest supply of commercially traded CO2 is in fact from a natural CO2 field, the McElmo Dome in Colorado, that contains close to 2 billion tons of high purity CO2. Another notable example is the Jackson Dome in Mississippi that holds around 250 million tons of high purity CO2. There are numerous natural CO2 fields within sedimentary basins globally. Some have held CO2 for millions of years without leakage, but many others do leak. Leakage generally manifests itself as carbonated springs or dry seeps.

CO2 Supply Sources2

Global CO₂ industrial demand has a modest impact on GHG emissions reduction, especially as majority of current consumption releases CO2 back into the atmosphere such as urea, enhanced oil recovery (EOR) and food and beverages. However, development in utilizing CO2 cannot be underestimated, particularly in downstream chemical synthesis. Much progress has already been made in recent years in the research and development (R&D) for processes that could produce chemicals and polymers from CO2, particularly in the production of methanol, fuels via Power-to-Liquids (PTL) and carbonates including polyols, polycarbonates, and concrete manufacture etc.

Key Advantages Over Alternatives for Storage and Utilization

Syngas and CO2 fermentation hold key advantages over other alternatives, including the ability to decarbonize other industry (e.g., steel production) as well as not having the following concerns and issues:

- Geological sequestration – Storage/leakage concerns, NIMBY issues with pipelines, poor impact with EOR

- Biochar – potential issues with land use

- PTL (e.g., eSAF or emethanol) – very expensive

- Organic carbonates (e.g., dimethyl carbonate) – small markets, with many not used in durable goods

- Other developmental routes (e.g., algae, carbon storing concrete) – very expensive, naecent in developent

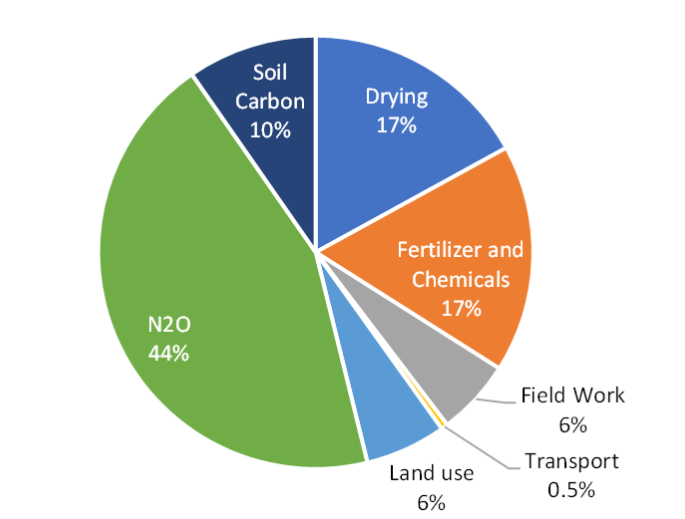

Solving For Corn Ethanol’s CI Problem

Corn ethanol has a high CI, partly due to corn itself having a high CI. Emissions primarily come from two places: energy use (direct such as fuel for farm equipment or indirect such as fertilizer production) or direct emissions of N2O are also released from nitrogen fertilizer and nitrogen in crop biomass. These N2O emissions account for almost half of the CI of corn. About 16 percent is related to the land itself: soil carbon and land use. The remaining roughly 35 percent is related to direct and indirect fossil fuel use: drying, fertilizer and chemicals production, fieldwork, and transport.

Carbon Intensity Of Corn3

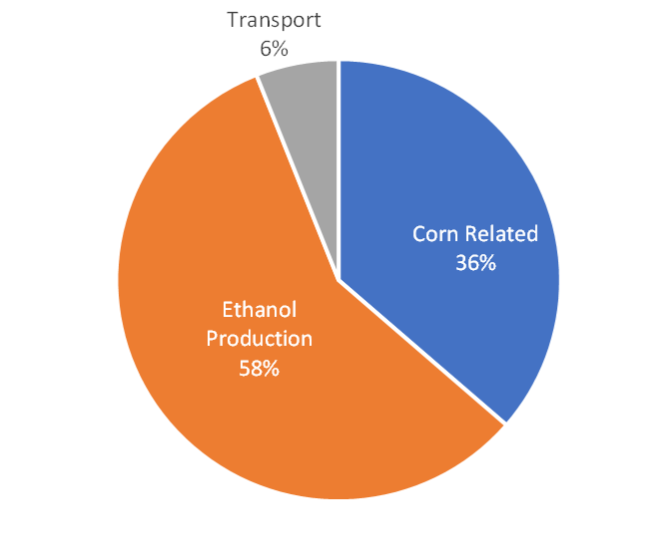

Ethanol production from corn can also be carbon intensive. This comes from a number of places, but most notably the heat and energy required for distillation and breaking of the azeotrope. Corn’s contained CI accounts for over a third of the CI of the produced ethanol, while the greatest contribution comes from producing the ethanol itself, almost 60 percent.

Carbon Intensity of Corn Ethanol4

Low CI CO2 fermentation based ethanol can help reduce the CI of ethanol production. As part of the fermentation to ethanol, a concentrated stream of wet carbon dioxide is produced that can be dried and captured. This is frequently captured for beverage utilization (e.g., carbonation of sodas)—however if captured and utilized for additional fermentation, this would reduce the overall CI by increasing the yield. Alternatively, low CI ethanol produced either via emissions or renewable-based syngas could supplement or replace existing supplies of higher CI corn ethanol.

Find out more…

Biorenewable Insights: Syngas and CO2 Fermentation (2024 Program)

This report analyzes the developments in syngas fermentation technologies. Syngas is a readily available gaseous feedstock that has the potential to provide developers of bio-based chemicals with both a cost and carbon intensity advantage in production. The purpose of this study is to assess the technical, commercial, carbon intensity, and economic aspects of syngas fermentation. Technology offerings from several developers include:

- LanzaTech

- CO Fermentation

- CO2 and Hydrogen Fermentation

- SynataBio

- CO and CO2 Fermentation

- CO2 and Hydrogen Fermentation

- Jupeng Bio

- Biomass Gasification

- Syngas Fermentation

- Low GHG Fermentation

Market Insights: Carbon Dioxide - 2023

This report provides analysis and forecasts to 2035 of the global carbon dioxide market. The report includes discussion regarding key trends, as well as supply review and demand outlook for nine regions: North America, South America, Western Europe, Central Europe, Eastern Europe, Middle East, Africa, Asia Pacific, and China with forecasts to 2035. Demand is segmented by urea, enhanced oil recovery, food and beverages, methanol, Power-to-Liquids (PTL) and others. Development in CO2 Capture, Sequestration and/or Utilization is reviewed. Cost competitiveness of CO2 derived chemicals is also included.

The Author...

Steve Slome, Principal

About Us - NexantECA, the Energy and Chemicals Advisory company is the leading advisor to the energy, refining, and chemical industries. Our clientele ranges from major oil and chemical companies, governments, investors, and financial institutions to regulators, development agencies, and law firms. Using a combination of business and technical expertise, with deep and broad understanding of markets, technologies and economics, NexantECA provides solutions that our clients have relied upon for over 50 years.