Global Lithium Chemicals Market Snapshot

Lithium chemicals, especially lithium carbonate and lithium hydroxide, are essential components in various industrial applications due to their unique properties. These chemicals are primarily used in sectors such as glass and ceramics, aluminium production, synthetic rubber, pharmaceuticals, chemical manufacturing, lubricants, batteries, and air conditioning systems. In the glass industry, lithium minerals can be used directly.

The importance of lithium in modern industries continues to grow, driven especially by the expanding demand for lithium-ion batteries. Lithium is used in primary (disposable) and secondary (rechargeable) batteries.

Primary batteries are used in military, industrial and commercial applications, and are becoming more important in electronic equipment. They provide high reliability, good shelf life, very low leakage rate, and long operating life, making them ideally suited for cardiac pacemakers. Lithium batteries have gained substantial market share because they outperform other primary battery systems, such as carbon-zinc, alkali-manganese, zinc-silver oxide. In addition, lithium batteries do not contain heavy metals, so are more environmentally friendly.

Secondary (rechargeable) batteries using lithium have problems with charging the anode. During discharge of the lithium anode, the lithium metal is consumed.

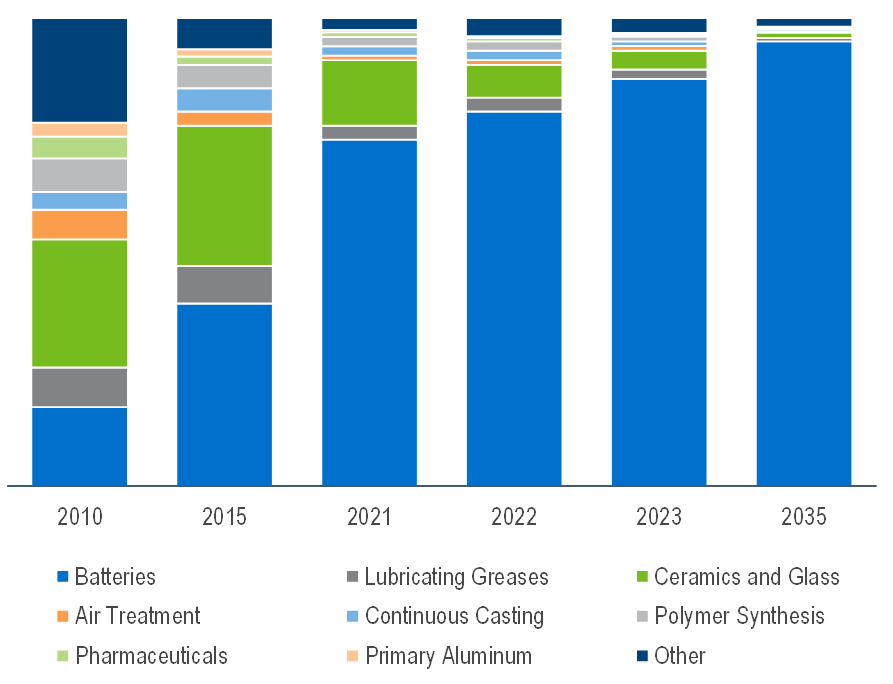

Global Lithium Demand by End Use (Percentage Share)

Global Lithium Demand by End Use (Percentage Share)

There are two lithium chemistries that can be used in electric vehicles (EVs) and lithium-ion batteries. They are lithium carbonate and lithium hydroxide. Historically, lithium carbonate was the primary chemistry used, but for technical reasons, the demand for lithium hydroxide in batteries has overtaken lithium carbonate.

Lithium is currently produced from two sources, lithium-rich brines, and lithium-bearing minerals. While the product from both processes can be lithium carbonate, hard rock typically produces a concentrate for use in more traditional applications such as glass, frits, and ceramics, of which the concentrate purified further will produce lithium carbonate.

Most producers currently prefer brine deposits. It is a less expensive operation and does not result in large volumes of bulky inert materials. The leading hard rock deposits are located in:

Western Australia

United States, including Nevada and North Carolina

Africa including Zimbabwe, DRC, Mali and Namibia

China.

The main brine deposits are in Argentina and Chile, with Bolivia and China showing promise. Bolivia has the largest brine reserves in the world.

Increased global production of lithium beginning in the past decade particularly in Australia, Chile, Argentina, and most recently, China has shifted world supply from the traditional U.S. sources to non-U.S. sources. Brazil, Portugal, and Zimbabwe partially meet their demand for lithium products with captive production of lithium-containing ores.

Substantial growth in lithium supply is forecast to 2029 as new mines and brines are developed and existing projects are expanded. Lithium production should exceed 1.5 million tons on a lithium carbonate equivalent (LCE) basis by 2035. Despite this large growth in supply, it is still not expected to be enough to meet demand as use in EVs and battery storage is growing at such a rapid pace. As a result, battery recycling is expected to become a key part of the supply chain.

Find out more…

Market Insights: Lithium Chemicals - 2024

This report provides a comprehensive review of the global lithium chemicals market, including lithium carbonate and lithium hydroxide and briefly lithium chloride and lithium metal,. The report focuses on the two primary sources of supply, lithium brines and hard rock spodumene.

Analysis includes a discussion regarding key market trends for each region: North America (United States, Canada, Mexico), South America, Western Europe, Central Europe, Eastern Europe, Middle East, Africa, Asia Pacific (Australia, India, Japan, South Korea, Other Asia) and China. Competitiveness analysis, including competitive landscape for lithium resources, lithium carbonate and lithium hydroxide. Price history and forecast for lithium carbonate and hydroxide is also included.